unfiled tax returns 10 years

If you havent filed a tax return for 10 years you dont have to deal with the process on your own. Many taxpayers have questions about unfiled tax returns and rightfully so.

What Happens If You Don T File Taxes For 10 Years Or More

We can help you.

. Unfiled Taxes Last Year. 7201 of the IRS Code if youre caught deliberately. There can be substantial penalties on balance-due returns.

Havent Filed Taxes in 5 Years. Youll need tax documents for the year youre filing your tax return for eg youll need your W-2 1099s or other documents from 2018 if youre filing your 2018. Havent Filed Taxes in 10.

Get Help If You Havent Filed a Tax Return for 10 Years. Tax agencies time limit is specific to the state so. As such according to Sec.

Havent Filed Taxes in 3 Years. Technically yes but its unlikely. Address penalties and any balances owed.

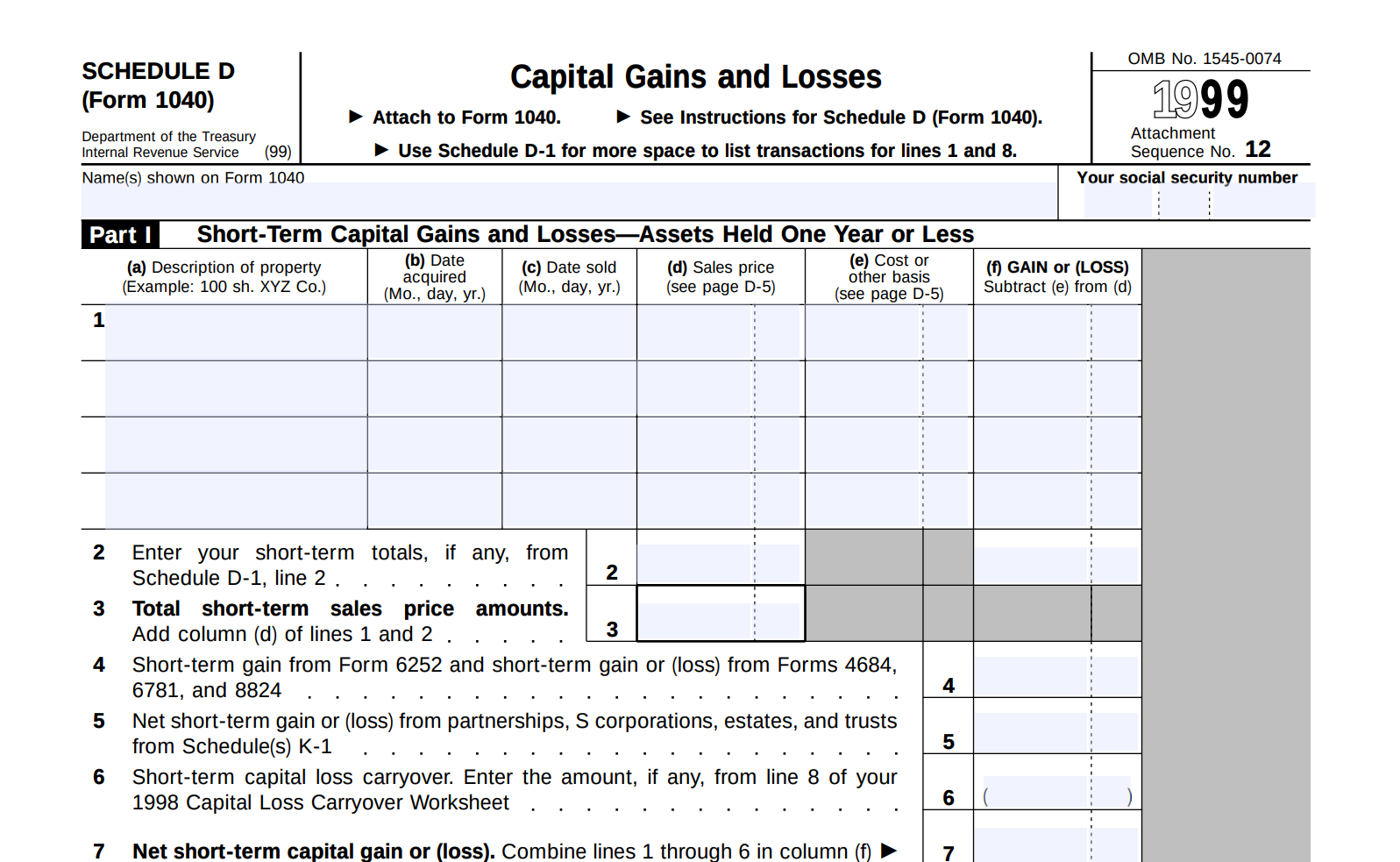

Systemically holds an individual taxpayers income tax refund when their account has at least one unfiled tax return within the five years. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. As a general rule Internal Revenue Manual 1214118 and IRS Policy Statement 5-133 states the IRS will require you to file the last 6 years of tax returns in order for you to be deemed.

For example you cant use 2001 tax forms and change. DeWitt Law prepared Clients tax returns and represented Client. Delinquent Return Refund Hold program DRRH.

Failure to file penalty 5 percent per month max of 25 percent. Many are worried about what the. Unfiled Tax Returns 10 Years.

Tax will be assessed and youll receive a notice demanding payment. Havent Filed Taxes in 2 Years. Important Unfiled Tax Return Warning.

Ca will use professional licenses to just come up with a balance. Create a template for future compliance. When you prepare your unfiled tax returns you must use the tax forms for the year you are filing.

There is no statute of limitations on a late filed return. In fact youre only protected by a time limit if you file your taxes at which point the IRS only has 10 years to collect from the date you filed. However in practice the IRS rarely goes past.

Once the SFR is filed your problems are just beginning. The good news is that the. 10 Years of Unfiled Tax Returns Client informed DeWitt Law that they had not filed a federal income tax return since 1995.

Many have not filed tax returns for 10 years or even 15 years or maybe never. Federal law mandates that the IRS assesses the payment of taxes. If you fail to file your taxes youll be assessed a failure to file penalty.

After the expiration of the three-year period the refund. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118. Expect the IRS to then take the following actions.

IRS Unfiled Tax Returns Total Guide. Missed the IRS Tax Return Filing Deadline. The IRS tax code allows the IRS to collect on a tax debt for up to 10 years from the date a tax return is due or the date it is filed whichever comes later.

Part of the reason the IRS requires. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. In most cases the IRS requires the last six years tax returns to be filed as an indicator of.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. Here are 10 things you should know about getting current with your unfiled returns.

Does The Irs Forgive Tax Debt After 10 Years

Unfiled Tax Returns Attorney In Mo Saint Louis Mo Tax Law Attorney Michael Krus

Back Tax Payment Services Unfiled Back Tax Returns Robert Hall Associates

Irs Tries To Reassure Pandemic Panicked Taxpayers

How Far Back Can The Irs Collect Unfiled Taxes

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

10 Facts About Taxes You Didn T Know The Motley Fool

What If You Have Unfiled Tax Returns

Unfiled Tax Help What To Do With Multiple Unfiled Tax Returns Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Do This If You Haven T Filed Taxes In 10 Years Bench Accounting

Filing Past Due Taxes How Many Years Will Irs Go On Unfiled Returns Youtube

What Happens If I Haven T Filed Taxes In Years In California

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

5 Possible Consequences Of Unfiled Tax Returns Nick Nemeth Blog

Unfiled Tax Returns What Are The Consequences

Posts Archives Page 6 Of 68 Mccauley Law Offices P C

What Should You Do If You Haven T Filed Taxes In Years Bc Tax